35+ how long work history for mortgage

And yes lenders frequently. Web Two Years the Standard Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain.

.webp?noresize)

Video Technology Platform Secure Video Communications Pexip

Web Generally speaking mortgage lenders require that you have at least two years of employment history to qualify for a loan.

. Web The Bottom Line. Once you settle into your home you face a new timeline of making mortgage payments for the. In fact the mortgage debt to income ratio rose from 20 to 73 percent.

Provided your last pay stubs covering 30 days of wages you need to. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

27 2022 at 1000 am. Looking For Conventional Home Loan. Complete Mortgage Process Timeline.

Most people will go. Ad 5 Best Home Loan Lenders Compared Reviewed. Web The lender may use the Request for Verification of Employment Form 1005 or Form 1005 S to document income for a salaried or commissioned borrower.

Browse Information at NerdWallet. Use NerdWallet Reviews To Research Lenders. An ideal scenario is when the borrower has at least two years of.

With a Low Down Payment Option You Could Buy Your Own Home. Browse Information at NerdWallet. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web If your application depends on Commissioned Overtime or Bonus income for you to qualify then the lender will be required to average the last 24 months of history for. Web On a 5 year mortgage homebuyers would pay interest-only payments for the 5 year term. The process of applying for a mortgage can be complicated but there are a number of distinct steps involved.

Comparisons Trusted by 55000000. Compare Lenders And Find Out Which One Suits You Best. Ad Why Rent When You Could Own.

Web The rise of the United States mortgage market occurred between 1949 and the turn of the 21 st century. Web The exact flexibility youll have will depend on your mortgage loan program and the lender you choose. Web Lenders want to know a lot about your work history when you In fact they will go back at least 24 months inquiring about where you worked as well as your income.

At the end of the 5 years they would face a balloon payment with the entire principal of. Web As a rule of thumb mortgage lenders will typically verify your employment and income for the last two years. Employment rules by loan type are as follows.

Web Getting a mortgage can be frustrating especially with all the work that goes on behind the scenes. Web Yes there is a standard within the mortgage industry that borrowers should have at least two years of employment and income history. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Most of that work is done by an underwriter who reviews and. Take Advantage And Lock In A Great Rate. With a Low Down Payment Option You Could Buy Your Own Home.

Take Advantage And Lock In A Great Rate. Ad Learn More About Mortgage Preapproval. To ensure you meet those.

Use NerdWallet Reviews To Research Lenders. Web With 6 months of work gaps you can get a mortgage but you have to provide as following also. Ad Learn More About Mortgage Preapproval.

Mortgage Broker St Kilda Access To Over 35 Lenders Mortgage Choice

Mortgage With Short Employment History Lending Guidelines

Keller Mortgage Deploys Mortgage Coach Enterprise Wide To Support Borrowers With Modern Mortgage Advice And Education Send2press Newswire

5 Ways To Use Video To Promote Your Mortgage Business

Aces Quality Management Taps Mortgage And Financial Services Qc Risk Experts To Headline 2023 Aces Engage Send2press Newswire

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

Cbs Intro 2015

How Long Should You Have Been At Your Job Before Applying For A Mortgage Strawhomes Com Richard Morrison

Gloria Shulman President Centek Capital Group Linkedin

8zira4pphursem

Careers Best Life Mortgage

Fha Loan Calculator Check Your Fha Mortgage Payment

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

Home Buying With A New Job How Long Must You Be Employed

35 Best Teacher Side Hustles To Boost Your Income

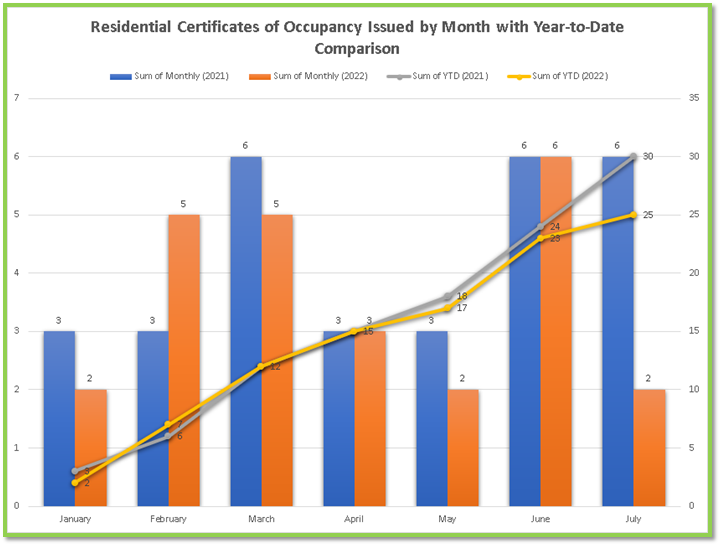

Management Report August 2022

A Main Street Perspective On The Wall Street Mortgage Crisis